Insurance Agency 1099

282007 Your 1099 will be offset by their payment of the premium to the insurance carrier. Box 169 Grand Rapids Michigan 49501-0169 Fax To.

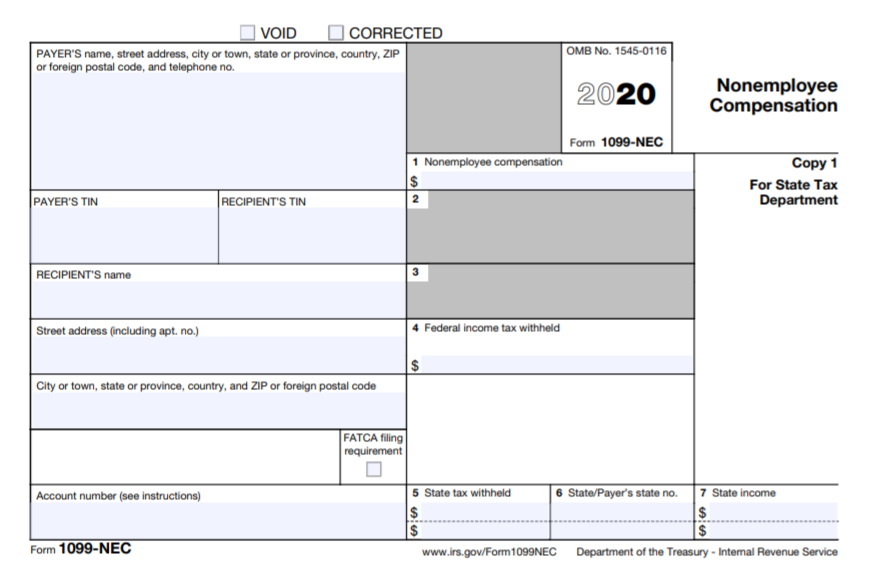

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc

So lets apply some of these tests to an insurance agency producer.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Insurance agency 1099. If you guys think its better to stay a W2 employee I guess I could always start a side business so I can still take advantage of write offs and just have. The Producer IS NOT managing revenues and expenses. Even in cases where the agent receives a W-2 from one insurance company he will frequently receive 1099s from other companies if he represents more than one line of insurance or one insurance company.

To properly protect themselves and their business they must obtain their own insurance. Being a freight agent has many attractive qualities. Please consult your tax and legal advisors to make certain that you are following the guidelines regarding how you treat your workers.

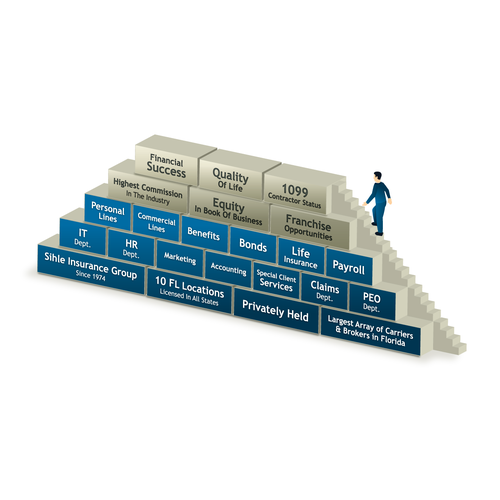

3282017 Many agents are independent contractors receiving either a 1099 as an independent contractor or a W-2 as a statutory employee. As an independent contractor 1099 you are your own boss work remotely and earn high commissions. Box 169 Grand Rapids Michigan 49501-0169.

General liability insurance for contractors which you can think of as 1099 insurance can help cover claims of. What Does Contractors General Liability Insurance Cover. 312021 If a business pays a commission fee directly to an insurance agency and that agency is unincorporated then that agency must receive a 1099-MISC if the payments made meet the 600 thresholdThe.

5242010 Independent Agents or Sub Producers Commission Structure will vary from agency to agency owner to owner but what is a fair sub produceragent commission structure for the following insurance. My thought is that my insurance company paid my mortgage company and not me this should even out my 1099-MISC Income with a deduction. Deal directly with how brokers are to report payments made by the broker to their customers.

What address do i put down as the business address. The insurance company usually audits ghost policies frequently. DeChristopher Keating Insurance Agency Corp.

Form 1099-G reports the total taxable unemployment compensation you received for the calendar year. So if you worked from a home. It would be highly unusual if not unheard of for an insurance agency to function as anything other than a corporation or a limited liability taxed as a corporation.

612019 I received a 1099 misc due to being an insurance agent receiving commission. What Kind of Insurance Do 1099 Contractors Need. Most 1099 pay used in insurance agencies are producers.

She wants to send me a 1099-- she is not an insurance company but a customer. People and businesses that operate as independent contractors arent covered by the insurance of the companies they provide with services. You may also call Agency Consulting Group Inc.

Property damage or bodily injury that your business causes. Enter the result appearing on Schedule 1 and ultimately on your Form 1040. Reputational harm as a result of malicious prosecution slander libel and more.

You may be assessed an insurance premium by your insurance carrier for a new employee or for a 1099 Independent contractors who does not have a Certificate of Insurance for Workers Compensation Insurance or the 1099s coverage lapses during the policy. 800-779-2430 to speak to Sherry Diamond EA. 1202015 I get a 1099 from all of the companies that I representThis is a customer that bought an insurance policy from me.

1262017 I do know lots of agents in my same position do get a 1099 but not sure if thats right or not. There are also downsides including a lack of health benefits available to you your sub-agents andor employees. You also dont need to 1099 the agent since you make your premium payment checks out to the agency or carrier and not to the agent himself.

In addition some companies require. As you can see most workers in insurance agencies will be defined as employees based on these considerations. As an agent I collected her payment then I sent the money collected from her to the insurance company less a 10 commission.

Independent contractors freelancers and sole proprietors should include their 1099 information when completing Schedule C to calculate their net business income. The business address will be the location where you performed your work. Talent Investment Agency UNEMPLOYMENT INSURANCE AGENCY Request for Form 1099-G Mail To.

Call our Inquiry Line at 1-866-500-0017. The broker information reporting rules under IRC Sec. 6045 and the underlying regs.

Unemployment Insurance Agency-1099-G PO. Selling insurance on behalf of the agency IS an integral part of the agencys business. TTY customers call 1-866-366-0004.

1099 N Division St. 212011 Im thinking that I should amend the filling and show the 1099-MISC as income and list the damage as a deduction of 20k with my insurance paying me 0.

11 Deductions For Independent Insurance Agents Hurdlr

11 Deductions For Independent Insurance Agents Hurdlr

Taxes 1099 R Public Employee Retirement System Of Idaho

Taxes 1099 R Public Employee Retirement System Of Idaho

Clearlink Insurance Agency Insurance Quotes 833 921 1099

Clearlink Insurance Agency Insurance Quotes 833 921 1099

Before You 1099 Make Sure You W 9 Cpa Practice Advisor

Before You 1099 Make Sure You W 9 Cpa Practice Advisor

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

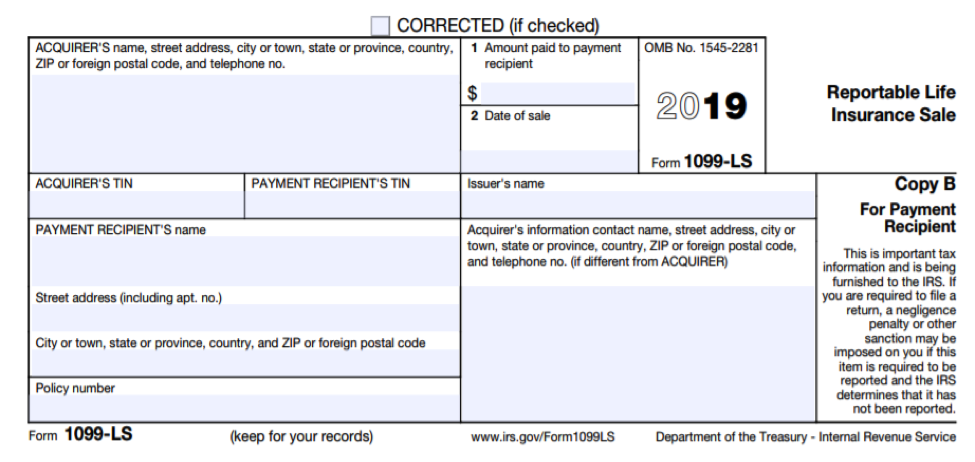

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/Clipboard02-a5156f9d1f374ac4bd6cea8b55ca7541.jpg) Form 1099 Int Interest Income Definition

Form 1099 Int Interest Income Definition

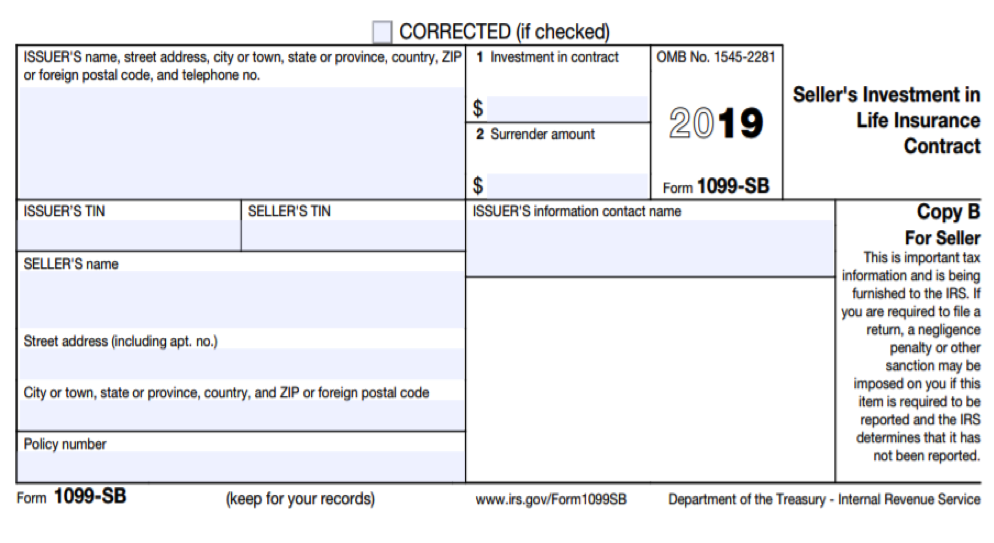

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

25 Tahun 55 Tahun Sudah 20 Tahun Bekerja Dengan Company Tidak Diduga Kena Insurance Marketing Life Insurance Marketing Insurance

25 Tahun 55 Tahun Sudah 20 Tahun Bekerja Dengan Company Tidak Diduga Kena Insurance Marketing Life Insurance Marketing Insurance

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Post a Comment for "Insurance Agency 1099"