1099 Life Insurance Taxable

682020 If you have a cash-value policy withdrawing more than your basis the money its gained is taxable as ordinary income. When is a 1099-R issued.

Irs Approved W 2 Pressure Seal Forms Pressure Seal Forms Save You Time And Frustration Pressure Seal Forms Turn The For Tax Forms Business Solutions W2 Forms

Irs Approved W 2 Pressure Seal Forms Pressure Seal Forms Save You Time And Frustration Pressure Seal Forms Turn The For Tax Forms Business Solutions W2 Forms

642019 Because you received a Form 1099-MISC for the life insurance payout this indicates that it is taxable income to you.

1099 life insurance taxable. 1099 Frequently Asked Questions What is a 1099-R. See Topic 403 for more information about interest. You will receive a 1099-R if you took a taxable distribution from your annuity in 2020.

532014 Life insurance proceeds are income-tax free and are therefore the insurance company does not send you a 1099 for the monies. 2172021 There is no inheritance tax on life insurance. 2112020 The instructions for Form 1099-R only say that no reporting is required for surrender of the policy if the insurance company reasonably believes that none of the distribution is includible in income.

If they know that there is 361796 of taxable gain implying that it is includible in income it seems that they must issue a Form 1099-R. In the case of per diem benefits the portion of. When the monies are paid to the beneficiary of the policy they can use the funds in the manner they see best.

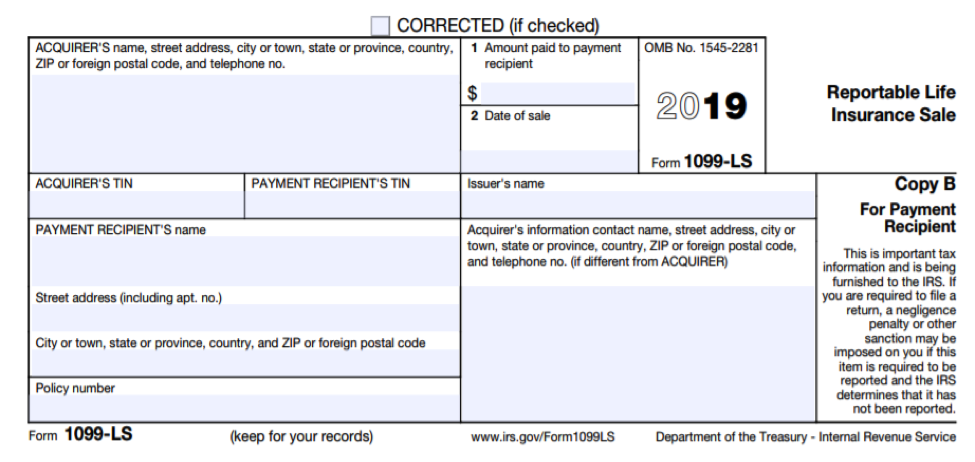

2182021 About Form 1099-LS Reportable Life Insurance Sale File Form 1099-LS if you are the acquirer of a life insurance contract or any interest in a life insurance contract in a reportable policy sale. 12142020 A life insurance policy loan is not taxable as income as long as it doesnt exceed the amount paid in premiums for the policy. However the 1099 forms are required simply to show the IRS you received tax-free benefits from your tax-qualified Long-Term Care Insurance policy.

More specifically Box 1 of the 1099-R will show the 50000 distribution. Generally there are no tax implications from their long-term care benefit. If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of.

2102021 Your 1099-LTC may list a large amount of benefits for which you may not necessarily owe taxes a tax-qualified policy. Do I report proceeds paid under a. Its best to check with your provider before you cash in -.

The gross amount of the distribution taxable amount employee contributions tax withholding and the distribution code are reported to the contract owner and the IRS. 10142020 Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. 1162020 You will however receive a 1099-R reporting a 50000 distribution paid to you by your life insurance company.

Bolt from the blue 1099-R life. This is one of the big attractions for people to buy life insurance policies. If you surrender your policy or.

See the Instructions for Form 1009-LS for complete filing requirements. A 1099-R is an IRS tax form that reports distributions from annuities IRAs retirement plans profit-sharing plans pensions and insurance contracts. Are life insurance payouts included in.

For non-qualified annuities a distribution is not reportable if only principal is withdrawn. In general terms you should reference forms such as Form 1099-INT or Form 1099-R that you receive to report the taxable amount. For additional information on this situation see IRS Publication 525 or read more about taxable and nontaxable income.

6222016 The problem of course is that the policy return is taxable while the policy loan interest is not deductible. If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction. The 1099 will report the distribution amount of 50000 and also report that 0 is taxable.

Life insurance death benefits are paid tax-free to your life insurance beneficiaries. A 1099-R is an IRS form used to report income from a retirement account like an annuity. However any interest you receive is taxable and you should report it as interest received.

It does not necessarily mean that the amount is taxable income to you.

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

3 Form 3 Dollars 3 Clarifications On 3 Form 3 Dollars Irs Forms Power Of Attorney Form American Express Card

3 Form 3 Dollars 3 Clarifications On 3 Form 3 Dollars Irs Forms Power Of Attorney Form American Express Card

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Free Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

Free Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

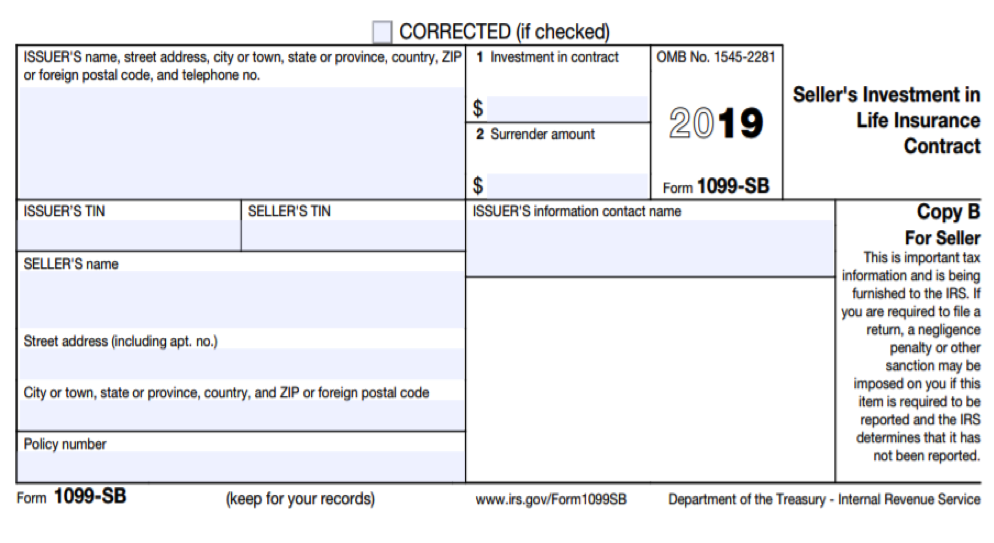

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Financial Tip Of The Month Tax Prep Checklist Tax Prep Tax Prep Checklist Financial Tips

Financial Tip Of The Month Tax Prep Checklist Tax Prep Tax Prep Checklist Financial Tips

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

1099 R User Interface Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Data Is Irs Forms Irs Tax Forms

1099 R User Interface Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Iras Insurance Contracts Data Is Irs Forms Irs Tax Forms

Life Insurance Company Market Share In 2016 The Top 3 Best Life Insurance Comp Best Life Insurance Companies Life Insurance Companies Best Term Life Insurance

Life Insurance Company Market Share In 2016 The Top 3 Best Life Insurance Comp Best Life Insurance Companies Life Insurance Companies Best Term Life Insurance

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

How To E File Form 1095 B Health Coverage With The Irs Irs Forms Irs Health Care Coverage

How To E File Form 1095 B Health Coverage With The Irs Irs Forms Irs Health Care Coverage

Post a Comment for "1099 Life Insurance Taxable"