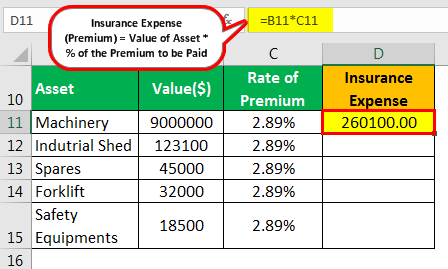

Insurance Expense Formula

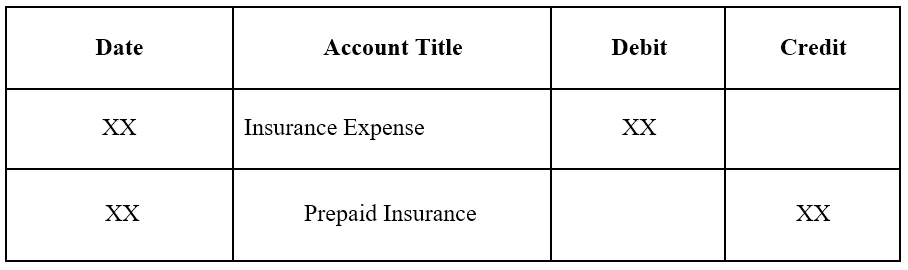

Under the accrual basis of accounting insurance expense is the cost of insurance that has been incurred has expired or has been used up during the current accounting period for the nonmanufacturing functions of a business. Equals insurance expense for the year 3267.

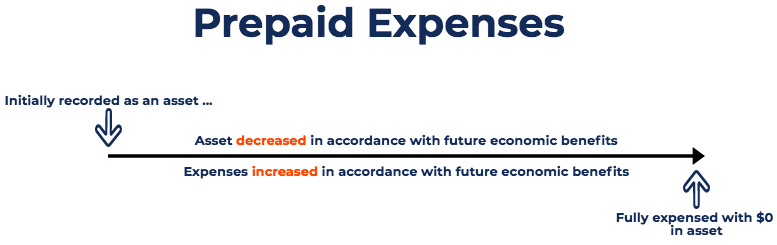

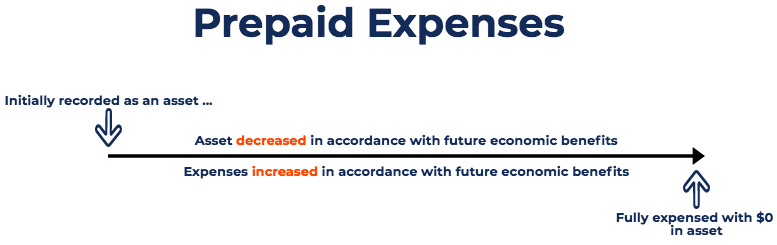

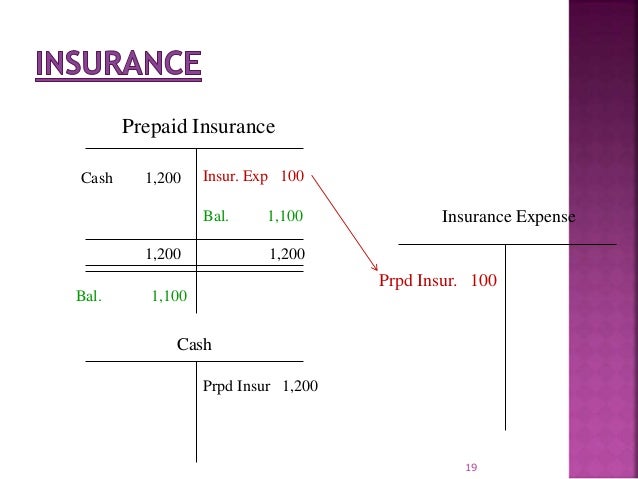

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

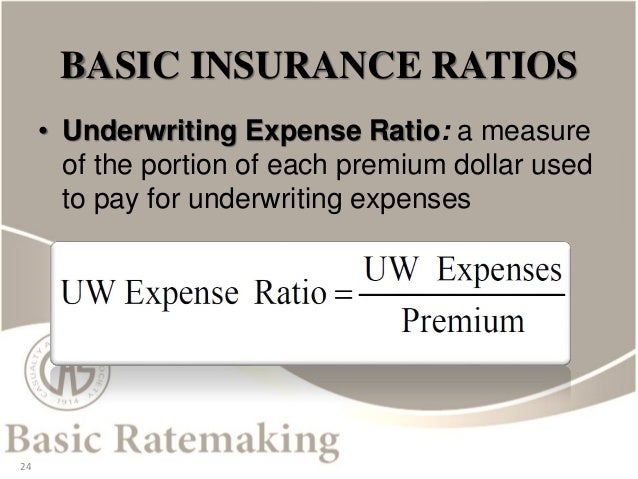

5222015 The statutory method where insurance companies divide their expenses by the premiums they have earned It is worth noting that expense ratios are a fundamental part of retrospective rating of basic premiums.

Insurance expense formula. In the meantime heres my answer. Add payment for insurance 4086. That means youre operating at a profit rather than a loss.

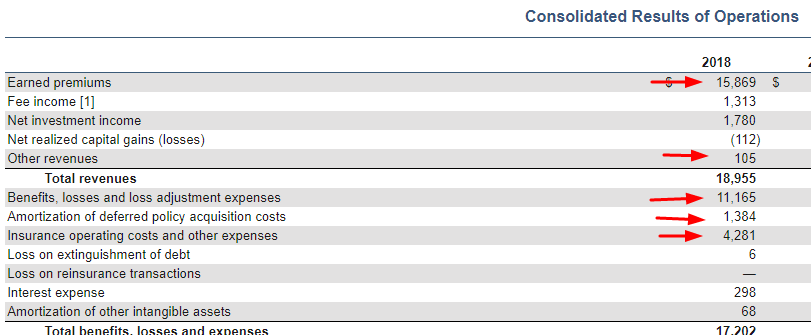

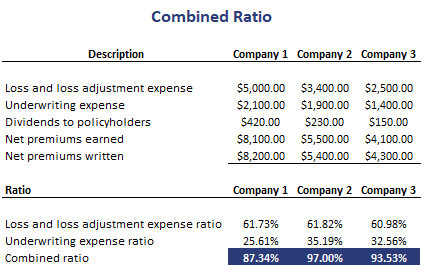

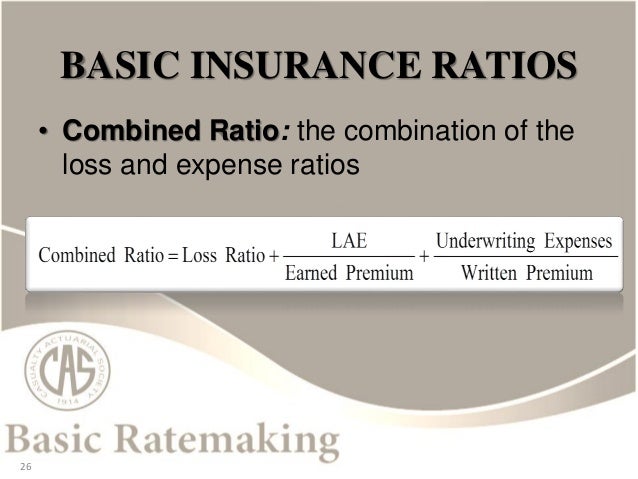

12142018 Once you have the earned premium you can incorporate it into the combined ratio formula. 11272020 A standard formula might look like this. 9302015 The underwriting expense ratio is a mathematical calculation used to gauge an insurance companys underwriting success.

Total claims paid out and loss adjustment expense LAE should not be included in the numerator for this calculation. In other words the cost of operating an insurance company shown in comparison to the percentage of sales is known as the Expense Ratio. The insurance expense was determined as follows.

The policies are designed to protect the company and employees from anything adverse that might happen. The benefit expense ratio is calculated by dividing the expenses incurred by the insurance companies to underwrite policies by the total premiums received during a particular period. The company then adjusted the insurance expense by moving the difference 8000 from the income statement to the balance sheet.

Business expenses such as advertising commissions and taxes on the insurers earnings are all examples of expense ratio costs. 8 months x 2000 16000. At the end of the year the company calculated what the insurance expense for 20X0 should have been.

8232019 Insurance expense is the charge that a company takes on for the insurance policy or policies it wants to protect itself and its workers. 100 Expense ratio formula can be further categorized as on basis of use 1- Administrative expense ratio formula. Is a measure of profitability used by an insurance company to.

Following formula is used for the calculation of expense ratio. Include only costs and premiums earned related to PC insurance in this calculation. 1252019 For example if you purchase 12 months of insurance divide your lump sum payment by 12 to determine the cost of one months insurance premium.

The formula is Combined Ratio Incurred Losses plus Expenses divided by Earned Premium. Operating expenses accounting supplies expenses on office supplies insurance licensing fees legal fees marketing and advertising payroll and wages repairs and equipment maintenance taxes. The payment made by the company is listed as an expense for the accounting period.

6122020 Insurance Expense Insurance Expense Insurance expense is the amount that a company pays to get an insurance contract and any additional premium payments. 7312020 The combined ratio also called the combined ratio after policyholder dividends ratio. Less closing balance 876.

Record the expense for one months insurance on your statement of cash flows as an insurance expense. Insuranceopedia explains Underwriting Expense Ratio. For example if you spend 1200 for the 12-month policy your monthly cost is 100.

2242020 In laymans terms the formula to get the Expense Ratio is dividing the expenses of the insurance company by Net Premium Earned. 8282013 Accounting questions should be under Other - Business. The agreement is that as the policyholder the company pays premiums on the policies.

Total PC Operating Expense PC Premium Earned 100. The figure you get will be expressed as a percentage and the goal of course is to have a ratio below 100. Particular Expense Particular expense Net sales.

If the insurance is used to cover production and operation. Insurance expense also known as Insurance premium is the cost one pays to insurance companies to cover their risk from any kind of unexpected catastrophe and is calculated as a set percentage of sum insured and is paid at regular pre-specified time period. Like loss ratio this ratio also has to be in control if the insurance company does not want to risk its profitability and solvency.

7242020 The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring underwriting and servicing premiums by. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses.

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

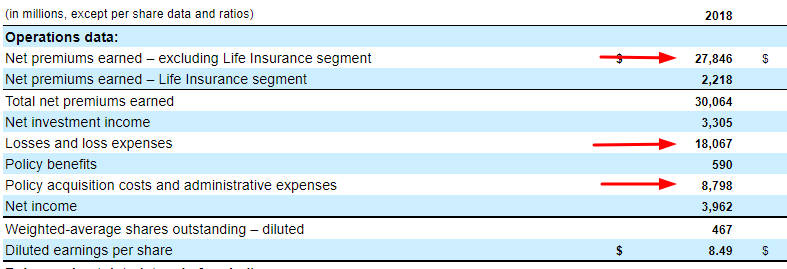

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio In Insurance Definition Formula Calculation

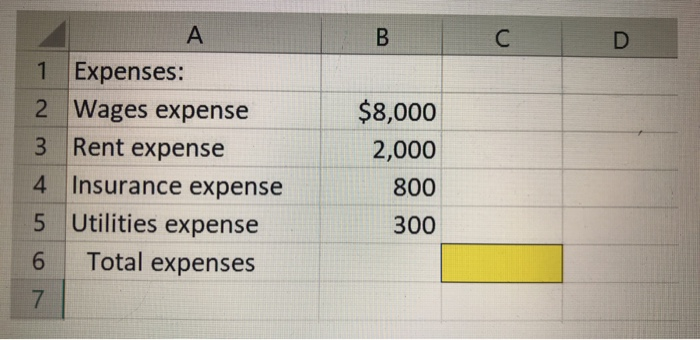

Solved Which Formula In Cell C6 Would Continue To Be Accu Chegg Com

Solved Which Formula In Cell C6 Would Continue To Be Accu Chegg Com

Insurance Ratemaking And Premium Data Analysis

Insurance Ratemaking And Premium Data Analysis

Prepaid Expenses Examples Accounting For A Prepaid Expense

Prepaid Expenses Examples Accounting For A Prepaid Expense

Insurance Industry Financial Ratios Expense Ratio Youtube

Insurance Industry Financial Ratios Expense Ratio Youtube

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

Insurance Industry Financial Ratios Loss Ratio Youtube

Insurance Industry Financial Ratios Loss Ratio Youtube

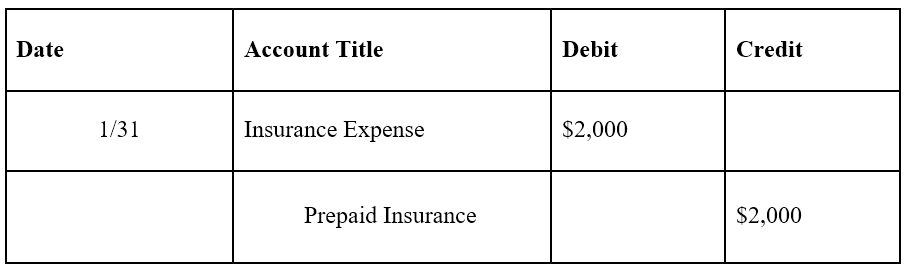

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Combined Ratio Breaking Down Finance

Combined Ratio Breaking Down Finance

Insurance Expense Formula Examples Calculate Insurance Expense

Insurance Expense Formula Examples Calculate Insurance Expense

What Is Operating Income Full Explanation Formula Example

What Is Operating Income Full Explanation Formula Example

Insurance Expense Formula Examples Calculate Insurance Expense

Insurance Expense Formula Examples Calculate Insurance Expense

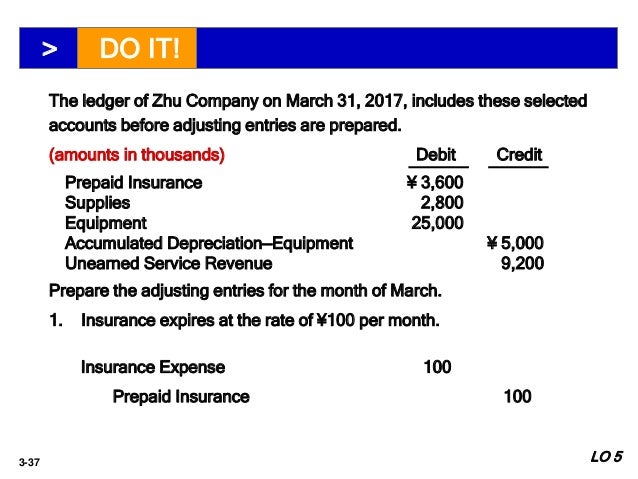

Topic5 Compthe Acccycle Robiah

Topic5 Compthe Acccycle Robiah

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

Prepaid Insurance Journal Entries For Prepaid Insurance Youtube

Prepaid Insurance Journal Entries For Prepaid Insurance Youtube

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

Post a Comment for "Insurance Expense Formula"