Insurance Expense Ratio Definition

Insuranceopedia explains Underwriting Expense Ratio. Expense Ratio the percentage of premium used to pay all the costs of acquiring writing and servicing insurance and reinsurance.

Chart Of Accounts Coa Examples And Free Pdf Download Small Business Bookkeeping Bookkeeping Business Learn Accounting

Chart Of Accounts Coa Examples And Free Pdf Download Small Business Bookkeeping Bookkeeping Business Learn Accounting

It is a crucial operating metric.

Insurance expense ratio definition. Expense ratios are important to consider when choosing a fund as they can significantly affect returns. PC Insurance Underwriting Expense Ratio measures total company operating expenses not including claims losses or loss adjustment expense relative to total PC premium earned over the same period of time. This money pays for things like the management of the fund marketing advertising.

A trade basis which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. Percentage of each premium rupee that goes to insurers. Expenses including overhead marketing and.

Expense ratio reflects the efficiency of insurance operations. 3202020 The insurance industry uses the benefit-expense ratio to describe the proportion of money taken in by a company compared to the amount paid out in claims. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses.

8312020 Expense ratio definition An expense ratio measures how much youll pay over the course of a year to own a fund. The combined ratio is arguably the most important of these three ratios because it. Definition of Insurance Expense Under the accrual basis of accounting insurance expense is the cost of insurance that has been incurred has expired or has been used up during the current accounting period for the nonmanufacturing functions of a business.

The cost of an expense ratio is deducted. What is Expense ratio. Insurance companies typically follow two methods for measuring their expense ratios.

7242020 The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring underwriting and servicing premiums by. Combined Ratio in Insurance Definition The combined ratio which is generally used in the insurance sector especially in property and casualty sectors is the measure of profitability to understand how an insurance company is performing in its daily operations and is by the addition of two ratios ie underwriting loss ratio and expense ratio. While interpreting expense ratio it must be remembered that for a fixed expense like rent the ratio will fall if the sales increase and for a variable expense the ratio in proportion to sales shall remain nearly the same.

The expense ratio does not include sales loads or brokerage commissions. 7312020 The expense ratio gauges the efficiency of an insurer and how well it uses its resources to drive top-line growth. An expense ratio of 1 per annum means that each year 1 of the funds total assets will be used to cover expenses.

There are two methodologies to measure the expense ratio. 9302015 The underwriting expense ratio is a mathematical calculation used to gauge an insurance companys underwriting success. The costs of operating an insurance company shown as a percentage of the money it receives from people paying for insurance policies Equitable is one of the lowest cost operators in the industry with an expense ratio expenses to premiums of 43.

9152020 An expense ratio is an annual fee charged to investors to cover the operating and administrative expenses of mutual funds and exchange-traded funds ETFs. 11152020 Loss ratio is used in the insurance industry representing the ratio of losses to premiums earned. 5222015 Expense ratio refers to the percentage of premium that insurance companies use for paying all the costs of acquiring writing and servicing insurance and reinsurance.

Because an expense ratio reduces a funds assets it reduces the returns. Expense ratio for an insurer would be analysed by class of business along with the trend of the same Combined ratio Loss Ratio Expense Ratio Combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer. 332021 The expense ratio refers to how much of a funds assets are used towards administrative and other operating expenses.

Losses in loss ratios include paid insurance claims. The trade method where insurance companies divide their expenses by the written premiums or. The lower the operating ratio the larger is the profitability and higher the operating ratio lower is the profitability.

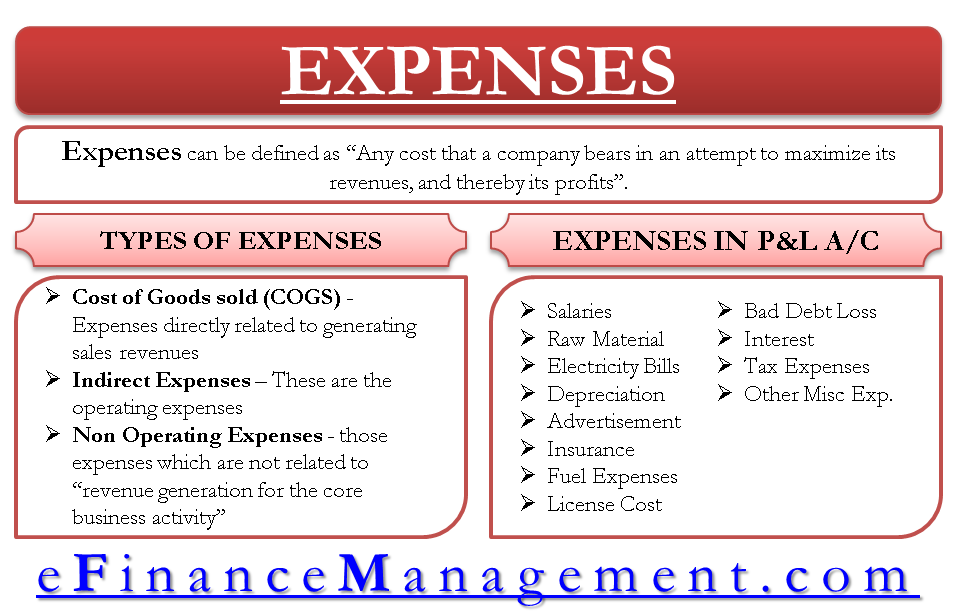

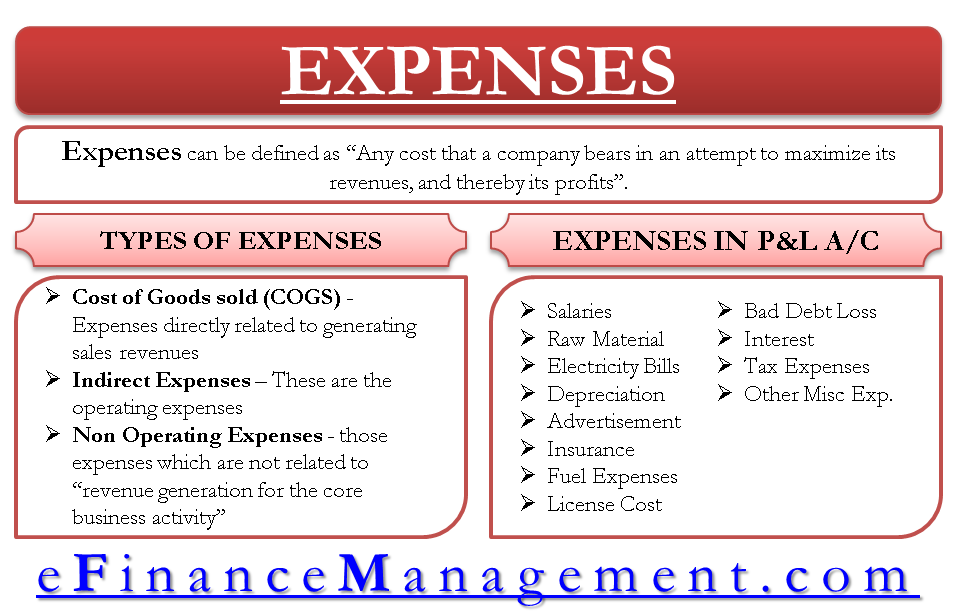

What Is Expense Definition And Meaning

What Is Expense Definition And Meaning

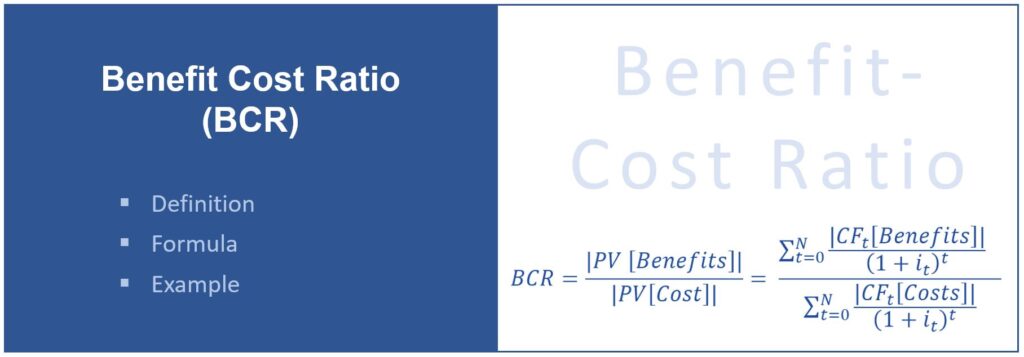

What Is The Benefit Cost Ratio Bcr Definition Formula Example Project Management Info

What Is The Benefit Cost Ratio Bcr Definition Formula Example Project Management Info

What Is Accounting Definition Types Financial Cash Flow Income Statement Balance Sheet Revenue Recogniti Accounting Cost Accounting Managerial Accounting

What Is Accounting Definition Types Financial Cash Flow Income Statement Balance Sheet Revenue Recogniti Accounting Cost Accounting Managerial Accounting

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintain Cash Flow Statement Cash Budget Statement Template

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintain Cash Flow Statement Cash Budget Statement Template

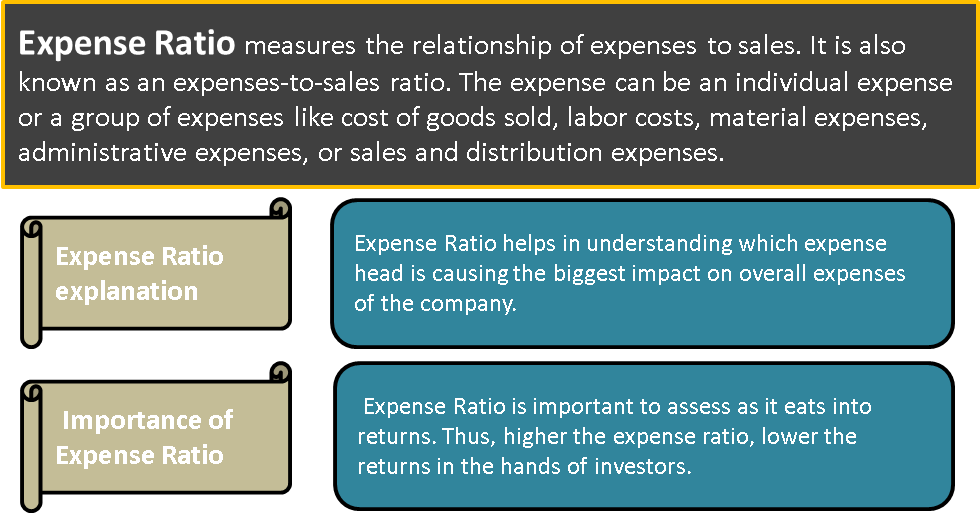

Operating Ratios Or Expense To Sales Ratios Formula Example Importance Behavior

Operating Ratios Or Expense To Sales Ratios Formula Example Importance Behavior

Combined Ratio In Insurance Definition Formula Calculation

Combined Ratio In Insurance Definition Formula Calculation

Operating Expense Ratio Formula Calculator With Excel Template

Operating Expense Ratio Formula Calculator With Excel Template

Contribution Margin Explained In 200 Words How To Calculate It Contribution Margin Words Cost Accounting

Contribution Margin Explained In 200 Words How To Calculate It Contribution Margin Words Cost Accounting

Multi Step Income Statement Income Statement Statement Template Budget Template Excel Free

Multi Step Income Statement Income Statement Statement Template Budget Template Excel Free

Chart Of Accounts Is Simply A List Of Account Names That A Company Uses In Its General Ledger For Recor Bookkeeping Business Accounting Basics Accounting Notes

Chart Of Accounts Is Simply A List Of Account Names That A Company Uses In Its General Ledger For Recor Bookkeeping Business Accounting Basics Accounting Notes

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing Sy Cost Accounting Income Statement Job

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing Sy Cost Accounting Income Statement Job

Chapter 3 Financial Statement Analysis Business Ratios Financial Statement Analysis Financial Analysis Accounting And Finance

Chapter 3 Financial Statement Analysis Business Ratios Financial Statement Analysis Financial Analysis Accounting And Finance

Income Statement Example Income Statement Statement Template Profit And Loss Statement

Income Statement Example Income Statement Statement Template Profit And Loss Statement

A Sample Income Statement Modified For Budget Variance Analysis Income Statement Financial Statement Analysis Financial Analysis

A Sample Income Statement Modified For Budget Variance Analysis Income Statement Financial Statement Analysis Financial Analysis

Operating Expenses Definition Explanation And Example List

Operating Expenses Definition Explanation And Example List

Petty Cash Voucher Format Form Sample Definition Template Free Example Reimbursement Expenses Voucher Petty Make Cash Fast

Petty Cash Voucher Format Form Sample Definition Template Free Example Reimbursement Expenses Voucher Petty Make Cash Fast

/AppleISdec2018OpCosts-5c6edec5c9e77c000151b9d2.jpg)

Post a Comment for "Insurance Expense Ratio Definition"