Insurance Lapse Rate Definition

A lapse of a privilege due to inaction occurs when the party that is. Have a lapse rate such that the expected number of premium payers is not around to collect benefits still need to be reserved carefully so that too much of the lifetime profit is not reported in the early durations.

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

A lapse ratio or expiration ratio is the ratio of policies issued by an insurance company at a certain time that are not renewed compared to the total number of policies issued during that same period.

Insurance lapse rate definition. Rather than face a substantial risk of lapsing and losing the. 5312017 It is calculated as the percentage of the insurers total insurance policies that remain in force without being lapsed or in simple terms it is the percentage of. Lapse Ratio the ratio of the number of policies that lapse during a period to the total number of policies written at the beginning of that period.

Life insurance demand in a calibrated rational-expectations lifecycle model with income shocks health shocks liquidity constraints reclassification risk and industry-average markups. Policy Lapse Rate Policy lapse rate measures the number of policies that are not renewed by policyholders. However some insurers may not penalize you for a short lapse of under two weeks.

A lapsed policy is simply a failure to renew on behalf of the policyholder. While this is true of all products ones with significant lapse support are the most difficult to gauge. 8162013 Its quite a bit more complicated than that and an insurer can make out quite well even if a whole life or universal life policy is held for a long long time.

The rate at which life insurance policies terminate because of failure to pay the premiums. They find lapse rates that are much lower than found in the data. Term GUL Disability and Long Term Care insurance.

Policyholders can find a number of reasons not to renew including too-high premiums poor customer service a bad claims experience or better marketing by a competitor that lures them away. 382021 When you take out a life insurance policy you pay a monthly or annual premium to keep the policy active. 522020 A lapse ratio or expiration ratio is a measure of the number of policies issued by an insurance company that are not renewed compared to the number of.

This ratio is an indicator of how well a company is able to retain a healthy number of policyholders. Fortunately a life insurance policy lapse wont happen immediately after one missed payment. A life insurance policy will lapse when both premium payments are missed and cash surrender value is exhausted if it is a permanent life insurance policy.

Lapse based or lapse supported pricingdesign generally only applies to policies without a non-forfeiture benefit ie. 1202005 Lapse supported products that perform as projected ie. If you stop paying those premiums your policy will lapse meaning you lose your life insurance coverage and your beneficiaries wont receive any life insurance money.

Termination of a policy upon the policy owners failure to pay the premium within the grace period. A lapsed policy is distinctly different from a cancelled policy in that a cancelled policy requires an action to cancel. 2192021 A lapse in car insurance is any period in which you have a registered car but do not have car insurance.

11122016 Definition - What does Lapse Ratio mean. 4272015 In life insurance termination rate refers to the rate at which insurance policies are terminated cancelled or permitted to lapse. A lapse can be as short as one day if theres any period youre without car insurance that counts as a lapse.

The lapse ratio is a comparison of the number of policies active in any given period with the number that were not renewed eg. This factor is one of the considerations taken in the determination of the premiums to be paid by policyholders under life and health policies. 5212019 A lapse is the cessation of a privilege right or policy due to the passage of time or inaction.

KRI Insurance Agency Performance Metric 2. If there are nonforfeiture values the policy lapses. 10132020 A lapse means a life insurance policy is no longer an active contract due to missed premium payments.

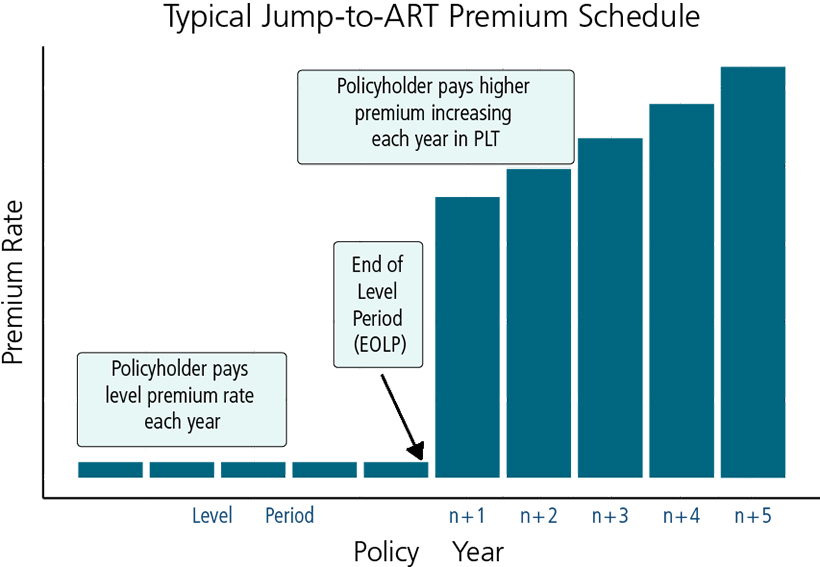

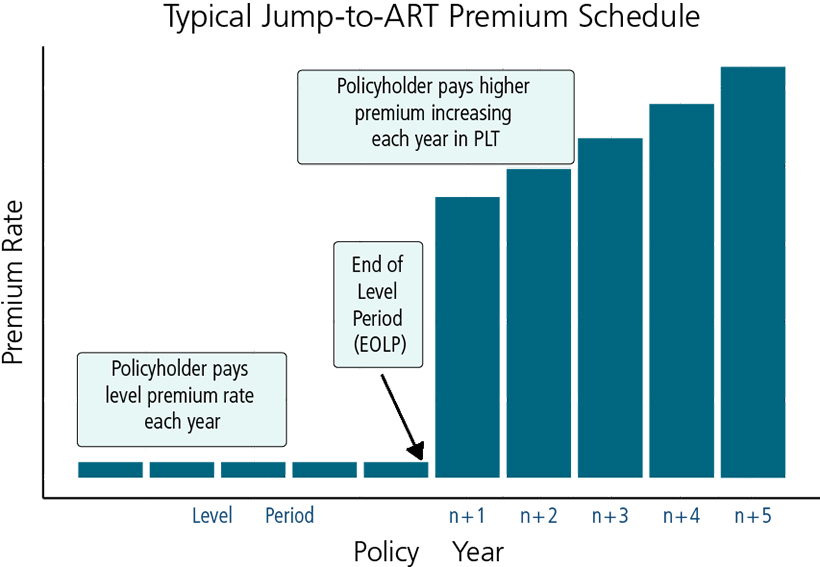

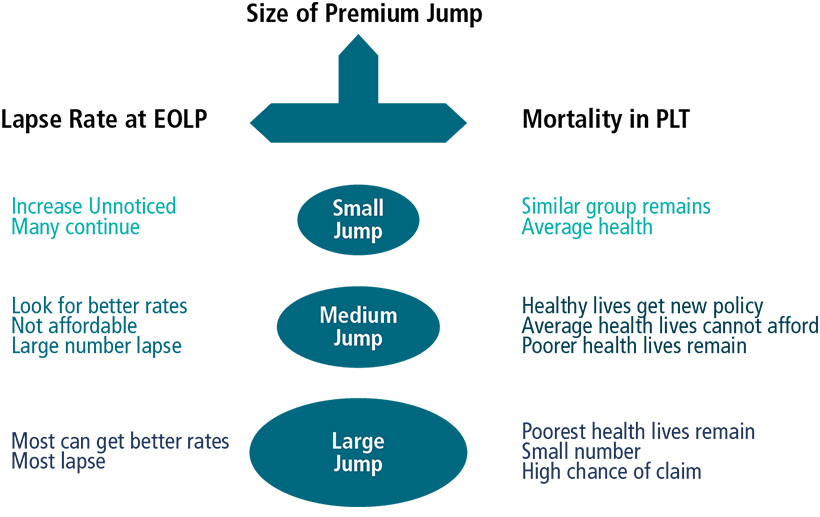

Modeling Behavior At Post Level Term Scor

Modeling Behavior At Post Level Term Scor

Driving Without Insurance How Bad Is It Https News Leavitt Com Personal Lapse Auto Coverage All About Insurance Coverage Auto

Driving Without Insurance How Bad Is It Https News Leavitt Com Personal Lapse Auto Coverage All About Insurance Coverage Auto

Modeling Behavior At Post Level Term Scor

Modeling Behavior At Post Level Term Scor

Unwinding An Irrevocable Life Insurance Trust That S No Longer Needed

Unwinding An Irrevocable Life Insurance Trust That S No Longer Needed

Https Hal Archives Ouvertes Fr Hal 01727669 Document

Http Www Actuaries Org Barcelona2017 Papers 25 Paper Xavier 20milhaud Pdf

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Http Www Actuaries Org Barcelona2017 Papers 25 Paper Xavier 20milhaud Pdf

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Http Www Actuaries Org Barcelona2017 Papers 25 Paper Xavier 20milhaud Pdf

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Lapse In Insurance Coverage Insurance Lapse Progressive

Lapse In Insurance Coverage Insurance Lapse Progressive

Http Diposit Ub Edu Dspace Bitstream 2445 115586 1 Tfm Caf Rahejabajaj Pdf

Zander Life Insurance Review The Zander Insurance Group Is A Well Established P Best Life Insurance Companies Life Insurance Quotes Life Insurance Companies

Zander Life Insurance Review The Zander Insurance Group Is A Well Established P Best Life Insurance Companies Life Insurance Quotes Life Insurance Companies

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Trends In Life Insurance Demand And Lapse Literature In Asia Pacific Journal Of Risk And Insurance Volume 14 Issue 2 2020

Here Is How To Renew A Lapsed Two Wheeler Insurance Policy Motorbike Insurance Compare Insurance Insurance

Here Is How To Renew A Lapsed Two Wheeler Insurance Policy Motorbike Insurance Compare Insurance Insurance

Post a Comment for "Insurance Lapse Rate Definition"