Unlimited Fdic Insurance

The unlimited deposit insurance coverage on noninterest-bearing transaction accounts is set to expire on December 31 2012. 4112019 The Federal Deposit Insurance Corporation FDIC was formed in 1933 as part of the Banking Act of the same year.

Online Banking The Way It Should Be Your Digital Bank Account Has No Overdraft Monthly Minimum Balance Or Set Up Banking Online Banking Online Bank Account

Online Banking The Way It Should Be Your Digital Bank Account Has No Overdraft Monthly Minimum Balance Or Set Up Banking Online Banking Online Bank Account

From December 31 2010 through December 31 2012 certain transaction accounts that pay no interest were entitled to unlimited deposit insurance coverage.

Unlimited fdic insurance. The extended coverage will end no later than December 31 2020. For some banks this may mean a change to their existing deposit agreement terms. The Board of Directors of the Federal Deposit Insurance Corporation FDIC today approved a final rule to implement section 343 of the Dodd-Frank Wall Street Reform and Consumer Protection Act Dodd-Frank Act.

Unlimited FDIC Insurance for Certain Transaction Accounts Comes to an End. Section 343 provides temporary unlimited coverage for noninterest-bearing transaction accounts. Therefore without a change in law by Congress as of January 1 2013 the FDIC will provide coverage only up to the standard maximum deposit insurance amount currently 250000 for each depositor at an insured depository institution.

3272020 One small and little-known provision of the CARES Act covers federal deposit insurance. Thats why we now offer FDIC insurance for CitiFX ProSM traders. In summary it temporarily provides unlimited coverage to noninterest-bearing transaction accounts.

The formation of the FDIC was in response to the many banks that failed during the Great Depression. That 250000 limit includes every account savings accounts checking accounts certificates of deposit and money market accounts which are different from the non-FDIC insured money. 1102013 The End of Unlimited FDIC Insurance.

If you open a deposit account in an FDIC-insured bank you are automatically covered. The official CitiFX Pro release states. 7212020 The math is.

11112011 Unlimited FDIC Insurance. And you dont have to purchase deposit insurance. All client US dollar deposits held by CitiFX Pro are fully.

Nov 11 2011 by Kurt. The 250000 limit is separate for each bank where you have an account. The FDIC became an independent government corporation through the Banking Act of 1935.

For the past two years IOLTA and non-in-terest-bearing accounts enjoyed unlimited FDIC insurance coverage pursuant to Section 343 of the Unlimited FDIC Insurance Coverage for. Part 330 which generally provides each depositor up to 250000 in coverage at each separately chartered IDI. Schnitzer In an attempt to limit the flight of deposits from insured.

The standard insurance amount is 250000 per depositor per insured bank for each account ownership category. Accordingly unless Congress acts prior to December 31 2012 as of January 1 2013 deposits held in non-interest bearing transaction accounts will be subject to the existing 250000 cap on FDIC insurance. The Federal Deposit Insurance Corporation is one of two agencies that provide deposit insurance to depositors in US.

Depository institutions the other being the National Credit Union Administration which regulates and insures credit unions. 472011 Consumer accounts can qualify for the unlimited deposit insurance if properly structured. FDIC regulation now defines noninterest-bearing transaction account as any deposit or account maintained at an FDIC insured bank or other depository institution with respect to which all three.

FDIC insurance covers depositors accounts at each insured bank dollar-for-dollar including principal and any accrued interest through the date of the insured banks closing up to the insurance limitThe FDIC does not insure money invested in stocks bonds mutual funds life insurance policies annuities or municipal securities even if these investments are purchased at. This unlimited coverage was separate from and in addition to the insurance coverage provided for a depositors other accounts held at an FDIC-insured depository institution. Counts are now insured by the FDIC only up to the standard maximum deposit insurance amount 250000 for each deposit insurance ownership category.

By having too much money in one bank or one account you may be putting yourself at risk. Effective January 1 2013 noninterest-bearing transaction accounts are no longer insured by the FDIC as a separate ownership category. 250000 from the father for Child 1 and another 250000 for Child 2 then 250000 from the mother for Child 1 and another 250000 for Child 2.

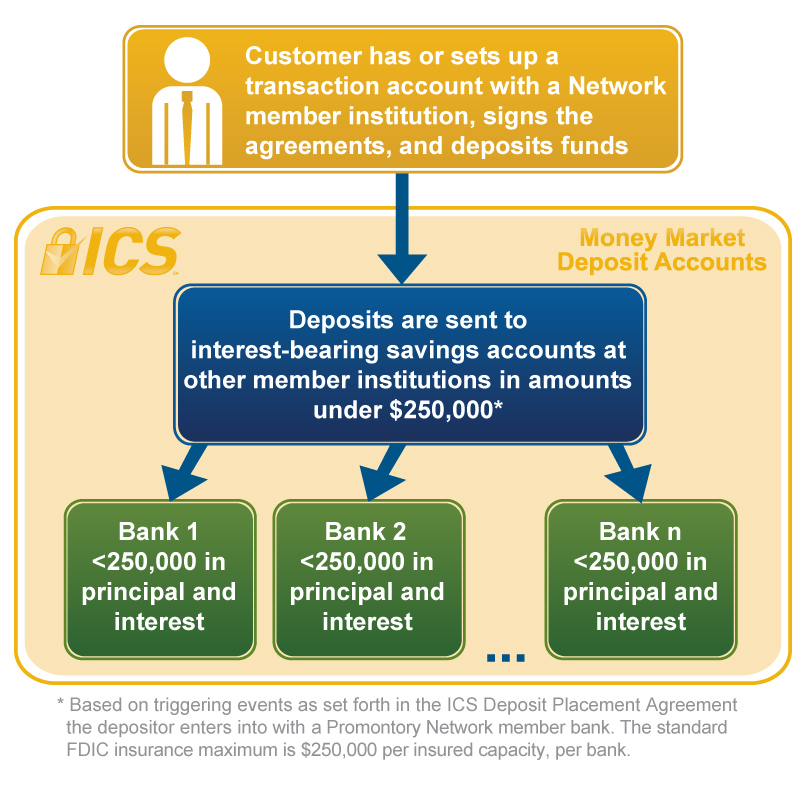

Such deposits will now be. Section 343 of the Dodd-Frank Act provides separate unlimited FDIC coverage for NIBTA depositors through December 31 2012. How Banks Can Retainand Depositors Can ProtectTheir Uninsured Deposits By Steven C.

If youre fortunate enough to have cash insurance needs well beyond 250000 its easy to garner practically unlimited FDIC insurance. Scored a near miss on economic calamity in 2008-09 the Federal Deposit Insurance Corporation FDIC increased deposit insurance to 250000. Unlimited FDIC insurance for Forex accounts.

222020 The FDIC maintains a 250000 coverage limit on deposits held at single financial institutions which might leave wealthier retirees in a bind when trying to protect their assets. Check out the resources on this page to learn more about deposit insurance. This applies to both the banks and credit unions.

The FDIC is a United States government corporation providing deposit insurance to depositors in US. Beginning January 1 2013 the FDIC will insure NIBTAs in accordance with 12 CFR. In the current economic environment protecting your deposits is of utmost importance.

3192021 FDIC insurance is not unlimited. So you can increase the FDIC insurance coverage available to you by using multiple banks or by structuring your accounts properly within a single bank. Commercial banks and savings banks.

Are My Deposits Insured. 11122012 Although the initial program was done under the FDICs existing statutory authority the FDIC has taken the position that only Congress can now extend the unlimited insurance program.

Accurate Roofing Investment Banking Investing Home Improvement Loans

Accurate Roofing Investment Banking Investing Home Improvement Loans

Why We Started A Trust Instead Of Just A Will My Money Design Car Insurance Insurance Policy How To Find Out

Why We Started A Trust Instead Of Just A Will My Money Design Car Insurance Insurance Policy How To Find Out

Pin By Ser On Places To Visit Index Incoming Call Screenshot Incoming Call

Pin By Ser On Places To Visit Index Incoming Call Screenshot Incoming Call

Flourish Canopies And Display Walls Wall Display Canopy Flourish

Flourish Canopies And Display Walls Wall Display Canopy Flourish

History And Timeline Of Changes To Fdic Coverage Limits Adm

History And Timeline Of Changes To Fdic Coverage Limits Adm

Learn How You Can Beat The Banks And Earn The Apr On Your Money That You Deserve We Offer 15 30 Apr With Fdic Insurance In 2020 Learning Finance Earnings

Learn How You Can Beat The Banks And Earn The Apr On Your Money That You Deserve We Offer 15 30 Apr With Fdic Insurance In 2020 Learning Finance Earnings

Pin On Books Articles Posts Etc

Pin On Books Articles Posts Etc

Other Documents Such As Drivers Authorization Or Notarized Statements Can Not Be Accepted Complete A Na Free Credit Card Credit Card Numbers Credit Card Info

Other Documents Such As Drivers Authorization Or Notarized Statements Can Not Be Accepted Complete A Na Free Credit Card Credit Card Numbers Credit Card Info

Unlimited Fdic Coverage Finemark Bank Finemark Bank

Unlimited Fdic Coverage Finemark Bank Finemark Bank

Checks Personal Business Print Self On Demand On Any Printer Save 80 Printing Software Online Checks Order Checks Online

Checks Personal Business Print Self On Demand On Any Printer Save 80 Printing Software Online Checks Order Checks Online

Insurance Articles Resources And Tips Nationwide Side Hustle Money Debt Payoff Budgeting Money

Insurance Articles Resources And Tips Nationwide Side Hustle Money Debt Payoff Budgeting Money

Wealthfront Launches 2 57 Apy Cash Account Accounting Investing Cash

Wealthfront Launches 2 57 Apy Cash Account Accounting Investing Cash

Aspiration Fights Wall Street Greed With High Interest Checking And Pay What S Fair Banking Saving Money Checking Account Aspire

Aspiration Fights Wall Street Greed With High Interest Checking And Pay What S Fair Banking Saving Money Checking Account Aspire

When And Where Is It On It Runs Monday Wednesday Oct 21 23 In Washington Dc At Three Locations Monday Is Held At Geo Fintech Online Tech Reading Material

When And Where Is It On It Runs Monday Wednesday Oct 21 23 In Washington Dc At Three Locations Monday Is Held At Geo Fintech Online Tech Reading Material

Get A Mcd Price Chart And Stay Up To Date With Other Helpful Info Invest In Mcdonald S Stock In 2020 Security Quotes Investing Federal Deposit Insurance Corporation

Get A Mcd Price Chart And Stay Up To Date With Other Helpful Info Invest In Mcdonald S Stock In 2020 Security Quotes Investing Federal Deposit Insurance Corporation

How Do I Upgrade Or Downgrade My New Stash Plan Official Stash Support Visa Debit Card Federal Deposit Insurance Corporation Investment Advisor

How Do I Upgrade Or Downgrade My New Stash Plan Official Stash Support Visa Debit Card Federal Deposit Insurance Corporation Investment Advisor

Post a Comment for "Unlimited Fdic Insurance"