Insurance For Leasehold Property

In England this is down to the Freeholder. Leases and Property Insurance Bill Locke Graves Dougherty Hearon.

Home For A Complete Family Or A Rental Money Earner Both Is Equally Possible Sale House Ubud Villa

Home For A Complete Family Or A Rental Money Earner Both Is Equally Possible Sale House Ubud Villa

Property insurance and liability insurance.

Insurance for leasehold property. If you are presently purchasing a leasehold property your solicitor will be able to advise you as to whether your lease requires you to take out leaseholder insurance protecting the building itself against the usual perils outlined in a landlord buildings insurance policy such as fire and flood. This was specified in the lease. If a tenant is prevented from using a property because of an insured title matter the tenant will be covered under this title insurance policy.

12192018 The law with regards to the insurance of leasehold property and reinstatement after damage or destruction can be uncertain and potentially unfair. Do I need buildings insurance for a leasehold property. 7182019 The property section of The Times has this month been leading on calls to end opaque insurance arrangements for leasehold blocks.

Many freeholders buy buildings insurance themselves then charge leaseholders a share of the cost via their service charge. 522017 For instance in Scotland the Leaseholder of a flat can insure the flat under buildings cover. Buildings insurance will be managed via the landlord although the costs for the insurance may well come from the service charge.

If you own a leasehold flat the building might be insured by the landlord who owns the freehold. The Leaseholder then usually pays a ground rent or service charge to the Freeholder. Your solicitor will be able to advise you if your lease means you have to take out buildings insurance.

Whos responsible for leasehold buildings insurance. If you own a leasehold flat you may find that your freeholder has already taken care of buildings insurance for the property. 8282012 In order to protect his leasehold interest a Tenant could obtain an Owners Policy of title insurance but an Owners Policy by itself doesnt address some of the issues that the Tenant would face if evicted from his lease because of a title problem.

There is no implied obligation on either party. 9172020 Leasehold interest coverage protects a business against the financial consequences of the loss of an attractive lease when the property is harmed or destroyed. 1112000 There are two basic types of insurance that impact leases.

Leasehold Interest property insurance covering the loss suffered by a tenant due to termination of a favorable lease because of damage to the leased premises by a covered cause. The landlord will usually be required to manage and maintain the structure exterior and common areas of the property to collect service charges from all the leaseholders insure the building and keep the accounts. A leasehold policy insures either the owner of a leasehold estate or a lender making a loan secured by a mortgage on the leasehold estate with respect to the title of the property.

In this property sounds similar to yours the leaseholders have to arrange and pay for the buildings insurance. In a sign of how leasehold is now dominating the news agenda the titles investment editor Mark Atherton has published on the issue of secret commissions over two consecutive Saturdays. Moody Austin Texas This article examines the role of property insurance in leaseholds.

The standard insurance forms and endorsements available to landlords and tenants are identified and discussed. With two of them I as the leaseholder had to pay for the buildings insurance but the policy was arranged by the freeholder and I just got the bill. Most policies are written on Insurance Services Offices ISO forms although special coverages can be negotiated and underwritten.

This insurance coverage is particularly important when a company is paying significantly less than the market rate to lease its premises. But if you are a leaseholder dont count on this. As the tenant you are entitled to see a full report on how your service money is.

Also discussed are additional forms of property insurance that are. 6112007 Ive lived in several leasehold properties in my time. Do you need buildings insurance if you own a leasehold flat.

7132016 Can a leaseholder buy buildings insurance for a leasehold property In some circumstances a leaseholder can arrange buildings insurance for a leasehold property they live in rent to tenants or for a leasehold unoccupied property.

A Tempting Small Hotel Business Opportunity In Ubud A Leasehold Property In The Western Part Of Ubud One Of The Prime Locations There Ubud Kolam Renang Spa

A Tempting Small Hotel Business Opportunity In Ubud A Leasehold Property In The Western Part Of Ubud One Of The Prime Locations There Ubud Kolam Renang Spa

I Bought A Leasehold Property Should It Matter The Edge Markets

I Bought A Leasehold Property Should It Matter The Edge Markets

24 Bids Received For Toh Tuck Road Site Singapore Property Launch Beauty Land Site Bukit Timah

24 Bids Received For Toh Tuck Road Site Singapore Property Launch Beauty Land Site Bukit Timah

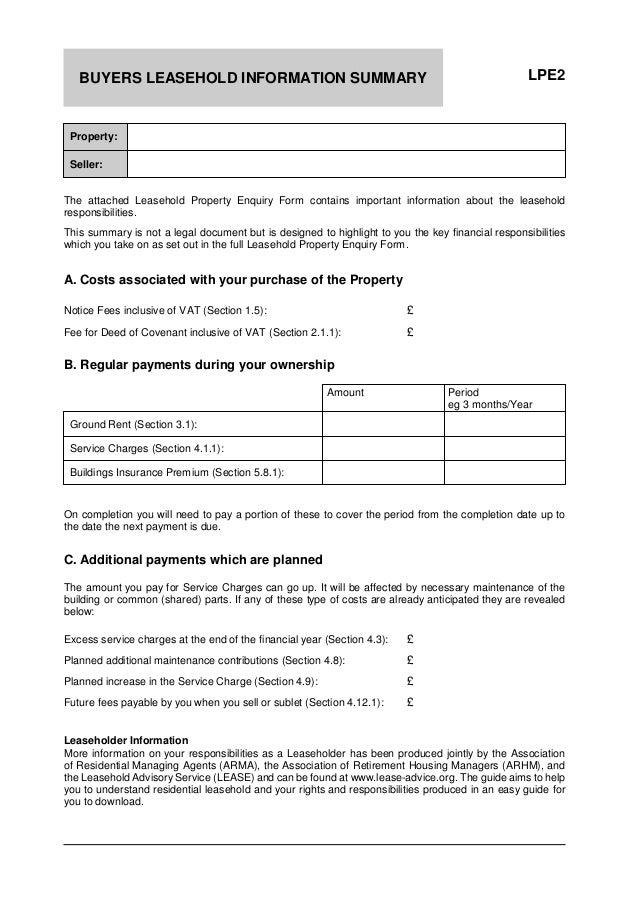

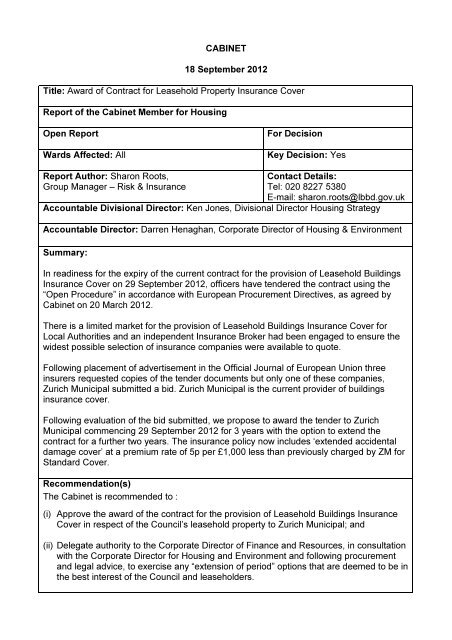

Leaseholder Property Insurance Contract Report

Leaseholder Property Insurance Contract Report

Beautiful And Very Special 2 Bedroom Villa Close To Ubud Ubud Bali

Beautiful And Very Special 2 Bedroom Villa Close To Ubud Ubud Bali

Fidelity National Title Insurance Company Law School Life Title Insurance Law School

Fidelity National Title Insurance Company Law School Life Title Insurance Law School

Ejen Hartanah Perak Hartanah Freehold Dan Leasehold Jenis

Ejen Hartanah Perak Hartanah Freehold Dan Leasehold Jenis

Selling A Leasehold Property Vs A Freehold Property 99acres

Selling A Leasehold Property Vs A Freehold Property 99acres

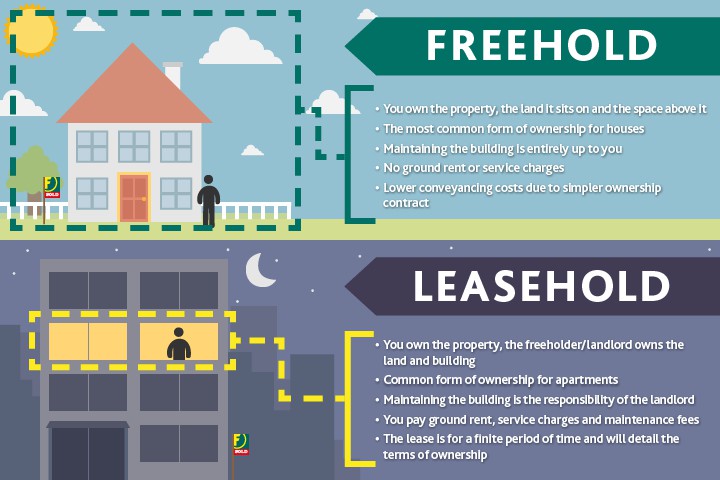

Difference Between Freehold Leasehold Property Realestate Freehold Lease Property

Difference Between Freehold Leasehold Property Realestate Freehold Lease Property

Important Real Estate Terms Everyone Should Know Commercial Real Estate Broker Real Estate Terms Being A Landlord

Important Real Estate Terms Everyone Should Know Commercial Real Estate Broker Real Estate Terms Being A Landlord

Blog Post What To Look Out For When Purchasing A Leasehold Property

Blog Post What To Look Out For When Purchasing A Leasehold Property

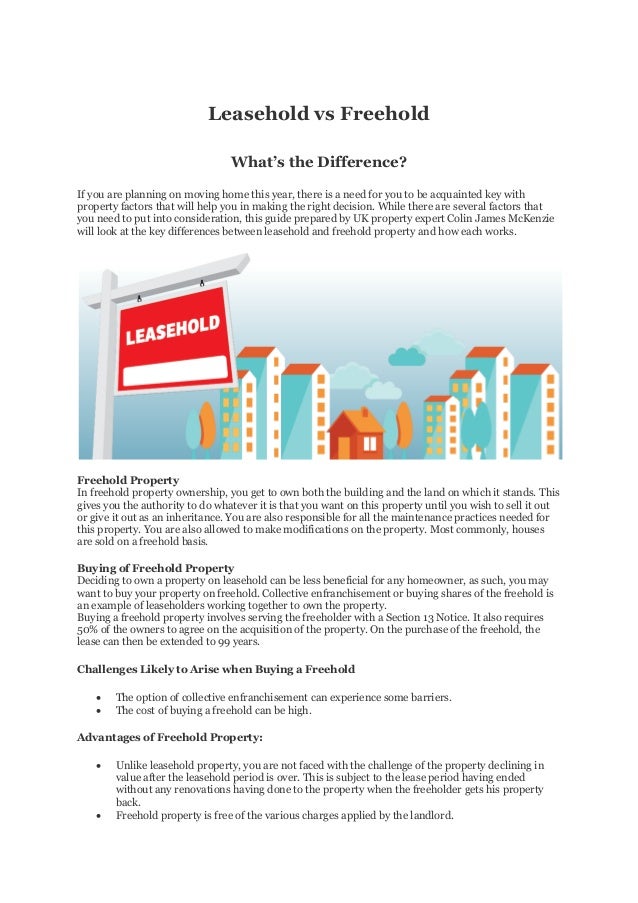

Leasehold Versus Freehold Property Colin James Mckenzie

Leasehold Versus Freehold Property Colin James Mckenzie

Image Result For Business Plan Financial Projections Sample Business Planning Financial How To Plan

Image Result For Business Plan Financial Projections Sample Business Planning Financial How To Plan

Freehold Vs Leasehold Freehold Common Myths Things To Sell

Freehold Vs Leasehold Freehold Common Myths Things To Sell

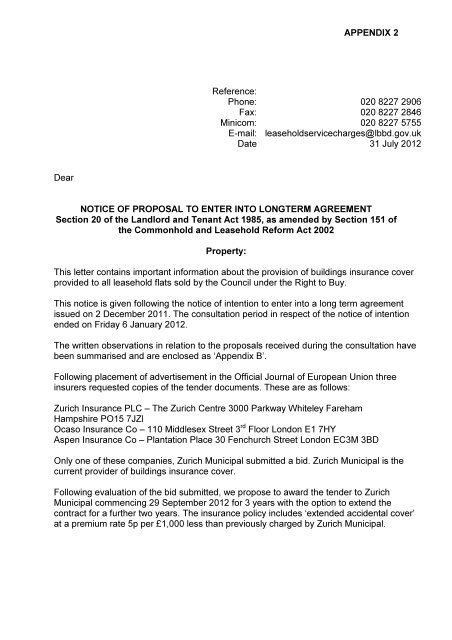

Award Of Contract For Leasehold Property Insurance Cover Pdf 47 Kb

Award Of Contract For Leasehold Property Insurance Cover Pdf 47 Kb

Proses Jual Beli Rumah Kos Rendah Kos Sederhana Rendah Pie Chart Property Chart

Proses Jual Beli Rumah Kos Rendah Kos Sederhana Rendah Pie Chart Property Chart

Difference Between Leasehold And Freehold By Mahzeb Monica Medium

Difference Between Leasehold And Freehold By Mahzeb Monica Medium

Situated Along A Stunningly Beautiful Valley In A Quiet Traditional Village Only Minutes From Central Ubud This Property Is Indeed A Rare Find Ubud

Situated Along A Stunningly Beautiful Valley In A Quiet Traditional Village Only Minutes From Central Ubud This Property Is Indeed A Rare Find Ubud

Post a Comment for "Insurance For Leasehold Property"